Latest Posts

How AI will change our lives in the next decade – Alvin Wang Graylin

AI is going to change our lives in the next five to ten years, says AI expert Alvin Wang Graylin, co-author of the new book Our Next Reality, in an interview at MRTV. “Nothing will be the same anymore! In this 90-minute in-depth discussion Alvin Wang Graylin gives us fascinating insights on how the AI-powered Metaverse will change all our lives and what we can do to make it an overall positive outcome for our society,” MRTV writes.Read More →

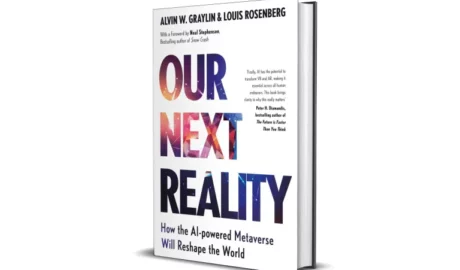

Alvin Wang Graylin’s book Our Next Reality available as e-book

The book by AI expert Alvin Wang Graylin and Louis Rosenberg “Our next reality” is available as an e-book and audiobook here. The book will be released on June 4, 2024.Read More →

Why China’s economy is weak, but surviving in the long run – Shaun Rein

China’s consumers are still nervous, the economy is weak, but looking good in the longer run, says Shanghai-based business analyst Shaun Rein at CNBC. Consumers are trading down now, but both real estate and infrastructure are not helping the economy, he adds. In the next decade, China’s middle class will grow from 400 to 800 million. Rein saw many of his clients move temporarily to Japan but is sure they will return to China.Read More →

Selling your China dream – Mark Schaub

About 90 percent of the China expats have left, estimates China lawyer Mark Schaub in his latest China Chitchat. And while new people are slowly coming back, those who left are struggling to sell their business, he says. What are the challenges they are facing, Schaub summarizes in the first part.Read More →

For multinationals, China cannot be replaced by India or Vietnam – Shaun Rein

Multinationals do not have to look at Vietnam and India as a replacement for China, says business analyst Shaun Rein at CNBC. In the next ten years China’s middle class is going to grow massively, and cannot be beaten by anybody else, he adds. “About 400 million poorer Chinese are getting into the middle class in the years to come,” he says.Read More →

China cannot roll over its debts anymore – Victor Shih

Financial expert Victor Shih dives into the 2024 figures at the annual NPC and concludes China cannot roll over debts anymore and finance its budget like it did before. He tells Bloomberg that central state policies have increasingly replaced a market-driven economy.Read More →

Why I don’t miss the premier’s annual press conference – Ian Johnson

In a surprise move, China canceled the annual press conference of the country’s premier. But long-term correspondent and author Ian Johnson explains in the VOA why he thinks the foreign correspondents stopped looking forward to the event.Read More →

How Alibaba conquered online pharmacy – Sharon Gai

Former Alibaba executive Sharon Gai looks at Drugstorenews back on how the company conquered retail in China, focusing on pharmacy with Alibaba Health. “What this medical doctor app did was digitize that entire process,” she said.Read More →

Can Saudi-Arabia follow China and US as a leader in AI? – Winston Ma

Winston Ma, an investor, attorney, author, and adjunct professor in the global digital economy, discusses at a Miami conference who can follow as leaders in AI for Arab News. He believes also countries like Saudi Arabia can follow those two leaders, although it does mean a lot of targeted investments.Read More →

Why Chinese enter the US through the Mexican border – Ian Johnson

A large number of the illegal immigrants entering the US from Mexico are Chinese, and not only poor Chinese, says China scholar Ian Johnson in DW. They mostly rely on dubious information on TikTok and have no clue what kind of adventure they get into, he adds.Read More →

Can China fix its inequality? – Zhang Lijia

Inequality has been one of China’s central problems, writes author and journalist Zhang Lijia in the South China Morning Post. There is no shortage of efforts to fix it, she argues, and while China has dealt with poverty successfully, getting to common prosperity, as it is called, seems much harder to achieve.Read More →

Manufacturing, not consumption, key for China’s economy – Victor Shih

China will continue to focus on supporting its manufacturing power, instead of changing to household subsidies, says economist Victor Shih, out of line with many other economists who expect support for consumption, as reported by Al Jazeera. Shih added: “There are 1.4 billion people in China, so comprehensive social assistance would be extremely expensive, especially in a deflationary context.”Read More →