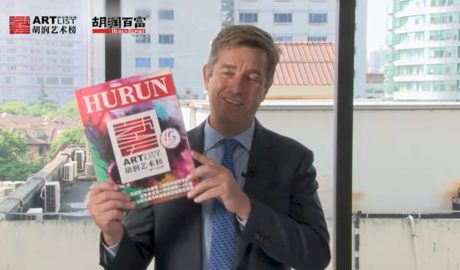

China’s economy: signs of slow recovery – Ben Cavender

After a slow start, after opening up after COVID-19, China’s economy is showing slow signs of recovery this autumn, says Shanghai-based business analyst Ben Cavender in the state-owned China Daily.Read More →