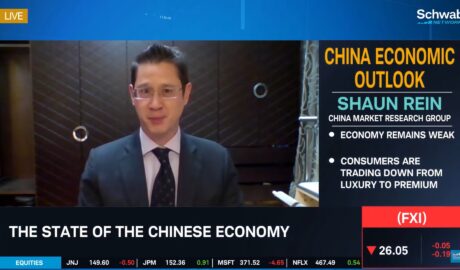

The ugly face of deflation – Shaun Rein

China’s consumers are trading down because of deflation, and are looking for cheap prices, says Shanghai-based business analyst Shaun Rein to CNBC. China’s government is unlikely to use financial support for the economy, he adds, as it finds the current growth of 5 percent quite enough, as its priority is dealing with the gap between the haves and have-nots, not at trying to increase that economic growth.Read More →