Finance has become a crucial subject when looking at China. Not only because its economy has boomed like crazy (and some claim it is even bigger than the US now). In the past, the central government and its financial regulator had a firm grip on the countries financial resources.

Now a massive row of Chinese companies, including Alibaba, are preparing for IPO´s, at home, insights in China´s financial industry are more important than ever.

The government wants to allow market forces to decide what financial direction the country is taking, and because more than even capital is owned by Chinese citizens, just looking at what the central government in Beijing is doing, is not longer good enough.

At the China Speakers Bureau, we are happy to have a range of eminent financial experts, who can help you to make sense out of the country´s financial development. A short overview:

William Bao Bean is Investment Partner at SOS Ventures and Managing Director of Chinaccelerator, the first and longest-running startup accelerator program in China based out of Shanghai.

William Bao Bean is Investment Partner at SOS Ventures and Managing Director of Chinaccelerator, the first and longest-running startup accelerator program in China based out of Shanghai.

Chinaccelerator invests in two batches of 10 startups per year in the Spring and Fall. The focus is on Internet, helping companies from China and across Asia attack, the global market and companies from across the world enter China and SE Asia.

You can read some of his articles here.

Arthur Kroeber is a respected writer and commentator on the Chinese economy and Chinese companies. He has been the managing director and head of research at Dragonomics since 2002.

In 2016 he published his much-quoted book China’s Economy: What Everyone Needs to Know®.

He began working in Asia in 1987 as a journalist specializing in economic affairs and has reported from China, India, and several other Asian countries. From 1992 to 2002 he was a correspondent of the Economist Intelligence Unit covering China and South Asia and was the author of numerous research reports on China and India.

In 2016 he published his much-quoted book China’s Economy: What Everyone Needs to Know®.

You can read his recent articles here.

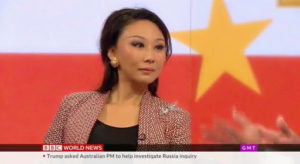

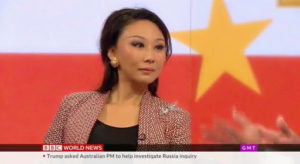

China has emerged as the second-largest economy in the world but has a hard time telling the world its story. Dr. Shirley Ze Yu is one of the very few exceptions in profiling herself as a solid China-voice, giving an alternative viewpoint on a mostly Western take on the developments of China and the world economy. Shirley Ze Yu is LSE scholar, fellow at Harvard Kennedy School and former Chinese national television (CCTV) news anchor Shirley Ze Yu.

She was vice President of strategies and innovation of Xin Yuan Group (NYSE and HKEX-listed), in charge of supervising and building two fintech (blockchain) startups. One of the blockchain companies was ranked in global top 5 in 2017 by patent numbers. She was also the deputy director of the Xin FIntech center under the Tsinghua PBOC School of Finance and co-led teams to draft policy white papers for the Chinese central bank on Fintech reforms.

She is a frequent guest on BBC News on China. She is a column contributor to the FT, and South China Morning Post. She is also a keynote speaker at leading global think tanks including the Chatham House, Asia Society, the Wilson Center, Harvard Kennedy School and the LSE, among many.

You can read her stories here.

Harry Broadman is a private equity Investor; PwC Emerging Markets Investment Leader; Chief of Staff, U.S. President’s Council of Economic Advisors; World Bank Official; Harvard Faculty; Author, Africa’s Silk Road: China and India’s New Economic Frontier

A globally recognized authority on China’s enterprise and banking reforms; 40+ years as senior business executive and board director throughout the emerging markets; Pioneering thought-leader on global business growth strategy, risk, and innovation.

You can read some of his recent articles here.

Victor Shih combines political and financial sciences as an assistant professor in political science at UC San Diego. Victor Shih was the first to explore China´s enormous debts, a huge financial burden, dragging down its economic development. In his book Factions and Finance in China: Elite Conflict and Inflation he analyzed the political and financial interactions of different political factions in China´s political elite.

You can read some recent articles here.

Ann Rutledge is founding principal and CEO of R&R Consulting, which is a pioneer in dynamic structured credit modeling tools.

Ann Rutledge´s insights on the often complicated credit markets are a welcome addition to our agency. She has been consulting to high-level representatives of China’s MIIT (Ministry of Industry and Information Technology), CCDC (China Bond), CFOs of large SOEs, SOE banks and security companies, municipal and commercial leaders of Hangzhou, Tianjin, Shanghai and Beijing cities, and national accounting and statistics bureaus under the Ministry of Finance. Other clients of R&R expert services have included the European Central Bank, U.S. Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Federal Financial Institutions Examination Council, the World Bank, Metlife, Mass Mutual, and other globally focused private equity firms and asset managers.

Shaun Rein, managing director of the China Market Research Group (CMR)

He is the author of The End of Copycat China: The Rise of Creativity, Innovation, and Individualism in Asia, his second agenda-setting book on China.

Shaun Rein is one of the world’s recognized thought leaders on strategy consulting in China. His book ´The End of Cheap China. Economic and Cultural Trends that Will Disrupt the World´, published in 2012, solidified his reputation of challenging established classic ways to frame China.

You can read some of Shaun´s recent contributions here.

Jim Rogers is the Chairman of Rogers Holdings and Beeland Interests, In and Co-founder of the Quantum Fund

Two decades ago Jim Rogers moved to Singapore as he emerges as a major bull on Asia. Since then he stuck to his guns as a successful investor, made sure his daughters were fluent in Mandarin and became a leading voice on investments in China, Asia and elsewhere.

Now he is predicting a bear market, the worst we have ever seen. Most recently he published Street Smarts: Adventures on the Road and in the Markets

Recently he sold his US shares for Chinese equity. One of the main assets of China, Rogers says, is the One-Belt, One-Road program.

Are you looking for more recent stories by Jim Rogers? Do check out this list.

Beida professor Paul Gillis is one of the leading voices when it comes to accounting in China. After a live a senior executive at one of the big four in China, he is now teaching the upcoming generation of leading financial experts at Peking University. On his weblog, he follows the fast-moving financial development and is an often quoted financial expert in mainstream media

Professor of practice and co-director of the IMBA program at the Guanghua School of Management at Peking University, CPA

You can read his recent articles here.

Are you interest in having these or other China experts at your meeting or conference? Do get in touch.